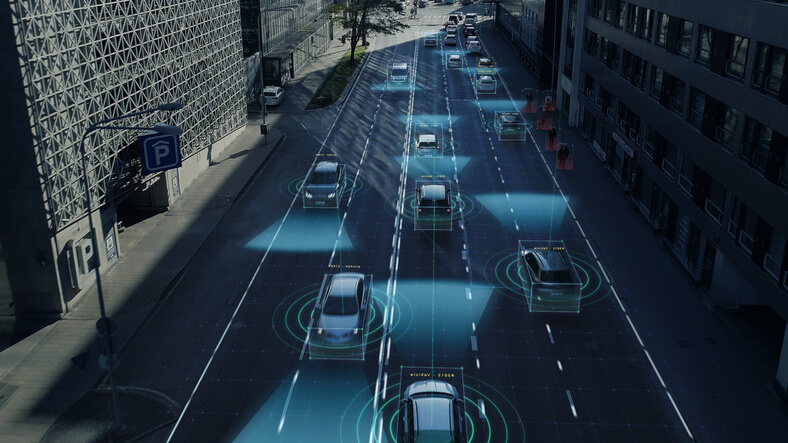

With the expanding popularity of self-driving cars and the increasing development of driver assistance technology, some people have concerns about the safety of pedestrians when vehicles do not have a human operator. When a pedestrian gets injured, it can be unclear exactly who might be liable for their losses. A South Carolina car accident attorney […]

Continue reading…

Penalties for Breach of Fiduciary Duty

Breach of fiduciary duty is an increasingly common accusation raised among people in business when they have disputes with their partners, managers, and employees. Usually, the penalties for breach of fiduciary duty are financial, since violations of a fiduciary duty often cause economic losses. If you suspect that someone has breached their fiduciary duty, you […]

Continue reading…

How Much is My South Carolina Personal Injury Case Worth?

Every personal injury case is unique because everyone’s injuries and losses are different. We cannot merely throw out a random number to represent the financial value of your South Carolina personal injury case. We will need to perform an investigation and talk to you before we can determine the answer to the question, how much […]

Continue reading…

What Are the Odds of Dying in a Car Accident?

Many people have anxiety when driving or riding as a passenger in a car. They might be surprised to learn how low their odds are of getting killed in a crash. They are much more likely to die of other causes rather than a collision. If you got hurt or a loved one died because […]

Continue reading…

What Should You Do After a Hit and Run Accident?

South Carolina law prohibits any involved party from leaving the scene of a car accident other than temporarily going to report the accident to the authorities. Unfortunately, not all people obey the law, and hit-and-run accidents occur. This can be a very stressful and overwhelming experience. Our South Carolina car accident attorney is here to […]

Continue reading…

Dissolving an LLC in South Carolina – Watch Out for These Four Things

It is relatively easy to set up a limited liability company (LLC) in South Carolina. After an LLC has served its purpose, or if you created an LLC for a start-up that never materialized, you might wish to dissolve the LLC. A South Carolina business attorney can provide legal advice on the steps you need […]

Continue reading…

What Are Non-Economic Damages?

If you’re injured in an accident, you may be entitled to certain damages that aren’t strictly economic. These are known as non-economic damages, and they can help compensate you for the pain and suffering you experience as a result of your injury. Non-economic damages can vary depending on the case but may include compensation for […]

Continue reading…

What Happens if I Was Hit by a U-Haul With No Insurance in South Carolina? Who is Liable?

Every year, thousands of people opt to use self-service trucks like u-hauls to move into new homes, complete projects, and much more. While services such as u-haul may make the process less expensive, most drivers are not experienced in driving commercial vehicles. As a result, accidents can occur. So, what happens if a u-haul driver […]

Continue reading…

What is a UCC filing?

The Uniform Commercial Code (UCC) governs commercial transactions between a debtor and a secured party. It is not federal law. Instead, it is uniform laws adopted at the state level. S. C. Code of Laws Title 36, Article 9 contains the laws adopted in South Carolina. A UCC filing is a security instrument used by […]

Continue reading…

Are Slip and Fall Injuries Covered by Homeowners Insurance in South Carolina?

Injuries incurred in premises liability cases can be significant. Luckily, most homeowners’ insurance policies cover slip and fall injuries. As a South Carolina slip and fall accidents attorney, I created some basic understanding of how your homeowner’s insurance can cover slip and fall injuries if they were to occur. Understanding Basic Homeowners Insurance Your homeowner’s […]

Continue reading…