With the expanding popularity of self-driving cars and the increasing development of driver assistance technology, some people have concerns about the safety of pedestrians when vehicles do not have a human operator. When a pedestrian gets injured, it can be unclear exactly who might be liable for their losses.

A South Carolina car accident attorney can help you sort out the liability issues and seek compensation for your injuries and losses. This article will discuss some of the challenges that can arise in situations involving self-driving cars and pedestrian injuries.

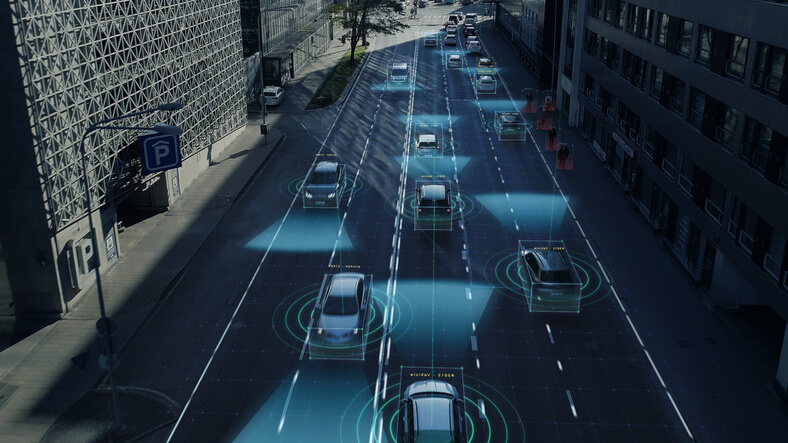

Self-Driving Cars and Expanded Driver Assistance Technology

The lines are becoming increasingly blurred between self-driving vehicles and the constantly increasing levels of driver assistance technology in today’s passenger cars and trucks. There are not many fully self-driving cars on the road. Usually, there is a driver in the driver’s seat who can jump in and respond to a crisis.

In some collisions, there are allegations that the driver relied too much on the driver assistance technology and failed to pay attention to the road. After some crashes, witnesses have accused the driver of having been asleep at the time of the wreck.

Driver assistant technology is improving from one year to the next. Some cars have sensors that alert the driver to the presence of an impending collision in front of, behind, or on either side of the car. Unfortunately, some drivers rely too much on this technology and avail themselves of the excuse to no longer pay attention to their surroundings while on the road.

Pedestrian Safety and Vehicle Technology

Some pedestrians also place too much faith in technology, assuming that cars with self-driving or other driver assistance features will protect the pedestrian from getting hit by the vehicle. Granted, some cars will automatically brake to prevent hitting another car or a walker, but not all vehicles have that capability. Pedestrians should always exercise caution before stepping into the street, even when they are in a crosswalk and crossing the street legally.

How to Prove Who Was at Fault

The legal analysis of liability is the same in every pedestrian accident. First, you establish the party had a duty of care toward the other person. Then, you show how the negligent party breached their duty of care and caused the collision. Finally, you prove the injuries and other losses of the plaintiff.

There is some confusion, when the plaintiff was not at fault, about who can be responsible when a self-driving car strikes a person on foot. Is the driver liable, the manufacturer of the car, or the company that developed the self-driving or driver assist technology?

The answer to that question will depend on the unique facts of the case. For example, if the driver negligently failed to devote their attention to what was happening on the road, and instead, took a nap or watched a movie on an electronic device instead of watching the road, the driver could get held responsible for the crash. On the other hand, if the car had a mechanical malfunction, the vehicle manufacturer could be liable.

Cases involving self-driving cars and pedestrian injuries are tricky, at best. You will want to talk to a South Carolina personal injury attorney about your case. Get in touch with our office today for help with your case.